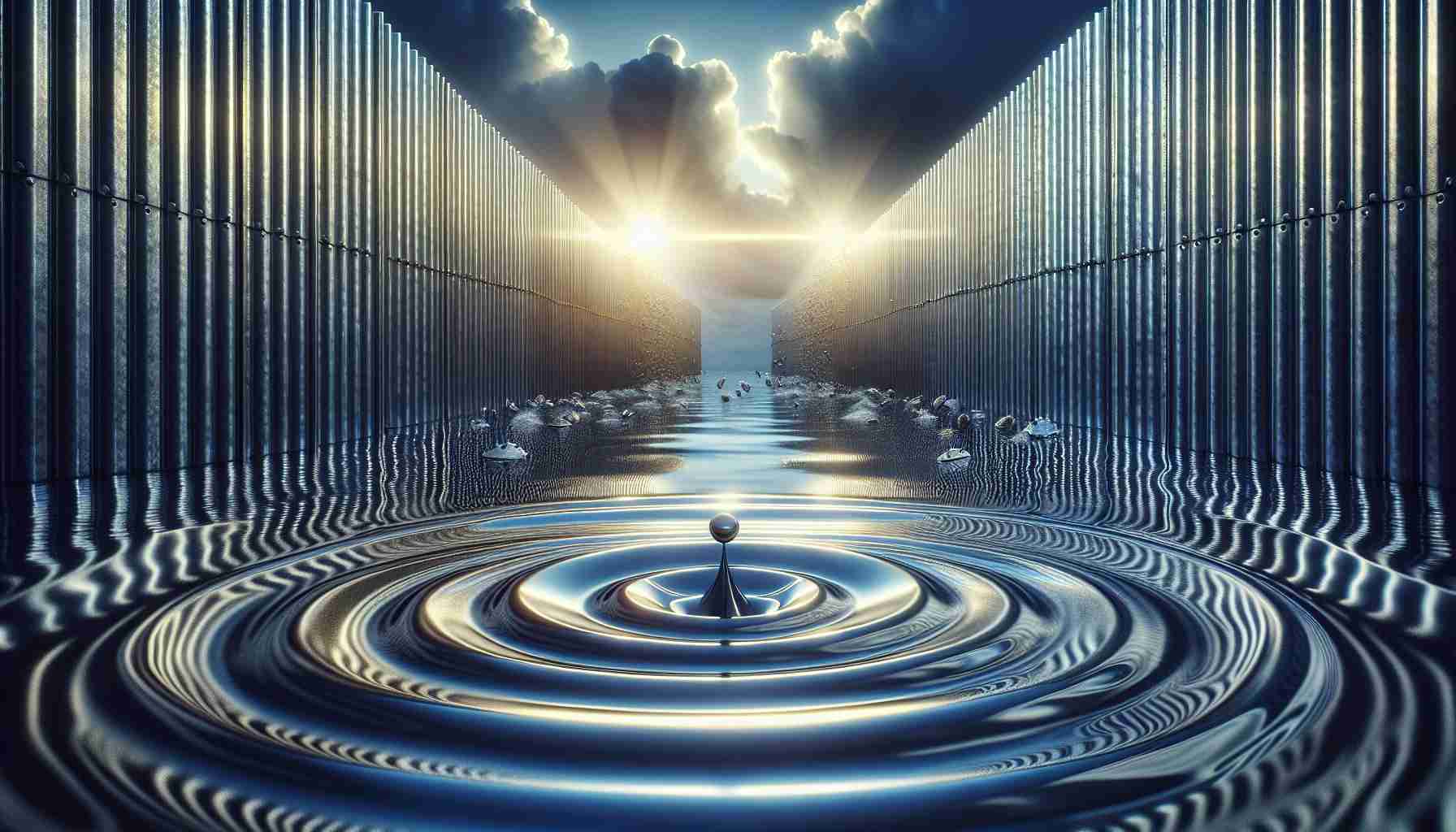

Steeling for Impact: The Rippling Effects of Trump’s New Tariffs

- President Donald Trump plans to impose a 25% tariff on all steel and aluminum imports to boost U.S. manufacturing and address trade inequalities.

- Key suppliers include Canada, Brazil, and Mexico, which provide nearly half of the U.S. steel intake, with Canada supplying nearly 40% of aluminum imports.

- This move is set to take effect by March 12 and may reshape industry landscapes, causing potential price increases and supply chain shifts.

- No exemptions are included in this draft, even for allied countries, prompting warnings of possible retaliatory measures.

- The 2018 tariff implementation serves as a cautionary tale, highlighting risks of oversupply and volatile pricing.

- The broader implications question whether domestic growth can be achieved without damaging international trade relationships.

Another wave of trade upheaval looms as President Donald Trump plans to impose a hefty 25 percent tariff on all steel and aluminum imports. Aiming to boost U.S. manufacturing and balance trade inequalities, the move sends shockwaves through global markets, threatening relationships forged in steel and aluminum.

Imagine towering skyscrapers and endless highways—the backbone of American infrastructure—dependent on steel’s unrivaled strength. Behind this sturdy curtain, nearly a quarter of such materials stream in from foreign lands, with steel giants Canada, Brazil, and Mexico leading the charge. These countries together supply nearly half of the nation’s steel intake. In the realm of aluminum, Canada more than dominates, contributing nearly 40 percent of U.S. imports, vital for the aviation and automotive industries.

This ambitious plan, set to unfurl by March 12, could redefine industry landscapes. But at what cost? The ghosts of 2018 hover closely, recalling soaring prices and altered supply chains. Back then, American steel mills rejoiced as walls of tariffs rose, only to find an oversupply crushing hopes with plummeting prices by 40 percent within months.

As global partners brace themselves, the absence of exemptions looms large in this draft—where even allies find no shelter from the tariff storm. Industry experts warn of retaliatory actions as ripples spread across sectors, jacking up prices for everyday products. The question lingers: Can the U.S. balance domestic industrial growth with international harmony?

In this unfolding narrative, the real metal isn’t just steel or aluminum; it’s economic resilience. As policies shift, the world watches keenly, gauges the reactions, and holds its collective breath for the final impact.

Potential Tariffs Set to Reshape Global Trade: Winners, Losers, and Future Predictions

Understanding the Broader Impact of Steel and Aluminum Tariffs

President Donald Trump’s decision to impose a 25 percent tariff on all steel and aluminum imports is not only a move affecting industries domestically but one that may ripple through global markets. It raises critical considerations concerning economic resilience worldwide.

This action, intended to bolster U.S. manufacturing and correct trade imbalances, positions American infrastructure industries at the forefront of a potential transformation. However, its effects are multifaceted, influencing both economic relations and the intricate web of global supply chains.

The International Ramifications

Steel and aluminum imports are essential for numerous sectors, supporting industries from construction to aviation. The main exporters to the U.S—Canada, Brazil, and Mexico for steel, and overwhelmingly Canada for aluminum—are impacted foremost, possibly leading to significant economic repercussions for these countries. Industry dependence on foreign steel and aluminum precisely because of cost-effectiveness and availability signifies cresting tensions as the tariffs take effect.

# Retaliatory Tariffs and Trade Wars

One major concern of these tariffs is the possibility of retaliatory tariffs from affected countries, potentially sparking a larger trade war. In 2018, similar tariff movements prompted retaliations from the EU and other countries, impacting sectors beyond the steel industry.

– Possible Consequences: Retaliatory tariffs could spread across various goods, affecting everything from agriculture to technology exports, ultimately increasing costs for consumers worldwide.

– Global Trade Relations: The strain on international relationships can reshape political alliances and economic partnerships. Countries affected by the tariffs may seek alternative trade agreements, strengthening ties with non-U.S. entities and potentially reducing reliance on American products.

Economic Prospects Within the U.S.

In theory, tariffs could boost domestic production by providing a competitive edge to U.S.-based manufacturers. However, this outcome is not guaranteed, and past instances, as seen in 2018, show that the temporary advantages can lead to oversupply and plummeting prices.

# Domestic Challenges

– Manufacturing Costs: U.S. manufacturers using imported steel and aluminum face increased production costs, likely translating to higher consumer prices and diminishing global competitiveness.

– Job Market Fluctuations: While certain jobs in the domestic steel industry may see short-term benefits, jobs in manufacturing sectors that rely on these raw materials could suffer, as businesses adjust to higher costs.

Future of Global Economic Policies

These shifts emphasize the need for diversified trade strategies and economic policies. Countries around the globe may need to reassess their economic planning and develop strategies to mitigate reliance on singular trade relationships.

# Technological and Scientific Progress

The tariffs have implications for industries pivotal to future innovations, such as automotive manufacturing and aerospace. Companies within these sectors might face resource constraints or be forced to innovate to reduce their dependence on raw materials sourced from foreign imports.

Key Questions Moving Forward

1. Balance of Growth and Diplomacy: How can the U.S. wage economic policies that protect domestic industries while maintaining healthy international relations?

2. Industry Adaptation: What strategies can industries adopt to manage increased costs and potential supply shortages?

3. Long-term Economic Health: Will these protective measures foster sustainable economic growth, or will they impose more harm than good in a globally interconnected economy?

For further insights regarding trade dynamics and broader economic trends, visit platforms like the Brookings Institution and International Trade Administration. These sources offer detailed analyses and projections useful for understanding complex economic landscapes.